Why Tax Was Imposed On Carbonated Drinks – FG

The Federal Government has disclosed its reason for introducing an excise duty of N10/litre on all non-alcoholic, carbonated and sweetened beverages.

Speaking during the public presentation of the 2022 budget on Wednesday in Abuja, Minister of Finance, Budget and National Planning, Zainab Ahmed, said the decision was in the interest of Nigerians.

The minister said the excise duty on soft drinks would discourage excessive consumption of sugary beverages which contributes to diabetes, obesity among others.

Ahmed added that the new tax would help raise revenues for the health sector and other critical expenditures.

The minister disclosed that the new policy introduced is in the 2021 Finance Act signed into law by President Muhammadu Buhari on December 31, 2021.

She said: “There’s now an excise duty of N10/ per litre imposed on all non-alcoholic and sweetened beverages.

“And this is to discourage excessive consumption of sugar in beverages which contributes to a number of health conditions including diabetes and obesity.

“But also used to raise excise duties and revenues for health-related and other critical expenditures.

“This is in line also with the 2022 budget priorities.”

Recall that in 2019, the finance minister had revealed that the federal government may introduce excise duty on carbonated drinks.

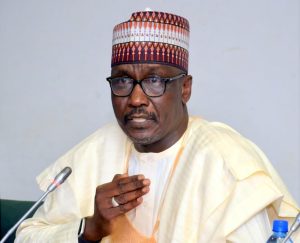

Also, the Comptroller-General of the Nigeria Customs Service (NCS), Hameed Ali, had proposed the collection of excise duty on soft drinks in 2021.

This article was originally published on Naija News